Corporate Governance

The SUNDRUG Group has a Corporate Philosophy, such as “Provide safety, reliance and convenience,” and “Start immediately from what we can do right at the moment, try to illuminate even just one corner of the world, make best decisions for all customers, employees, shareholders, business partners, communities, society, and the global environment, and always act with thoughtfulness,” based on its basic management policy of aiming to “realize healthy, rich prosperous lives for the Japanese people and contribute to the creation of good cheer and fun in daily life.” We realize that it is important to build an effective corporate governance system in order to achieve them. We are aware of our responsibilities for all stakeholders, including shareholders, position corporate governance, compliance, risk management, etc. as important management issues, establish a management system to make fair, transparent, and conscientious decisions from a medium- to long-term perspective, and disclose management strategies and plans in a timely and appropriate manner. Furthermore, we adapt to changes in the environment, continuously enhance the significance of the Group’s existence, and strive for long-term, stable, and sustainable growth and higher corporate value of the Group.

1. Ensuring soundness, objectivity, and transparency of management

In December 2018, the Company established the Nomination and Compensation Advisory Committee as an advisory body to the Board of Directors to ensure soundness, objectivity, and transparency of management. The Committee currently consists of three External Directors, the President and Representative Director, and the Director and General Manager of the Administrative Division. The President and Representative Director serves as the Chairperson of the Committee. In fiscal 2020, the Committee was held six times, and the attendance rates of the members were all 100%. Agendas included a proposal of officer compensation (including bonuses for Internal Directors), a proposal of a design of a compensation system, a proposal of criteria for appointing and dismissing officers, and a proposal of appointment of candidates for Directors and Audit & Supervisory Board Members, and results of the deliberations were reported to the Board of Directors.

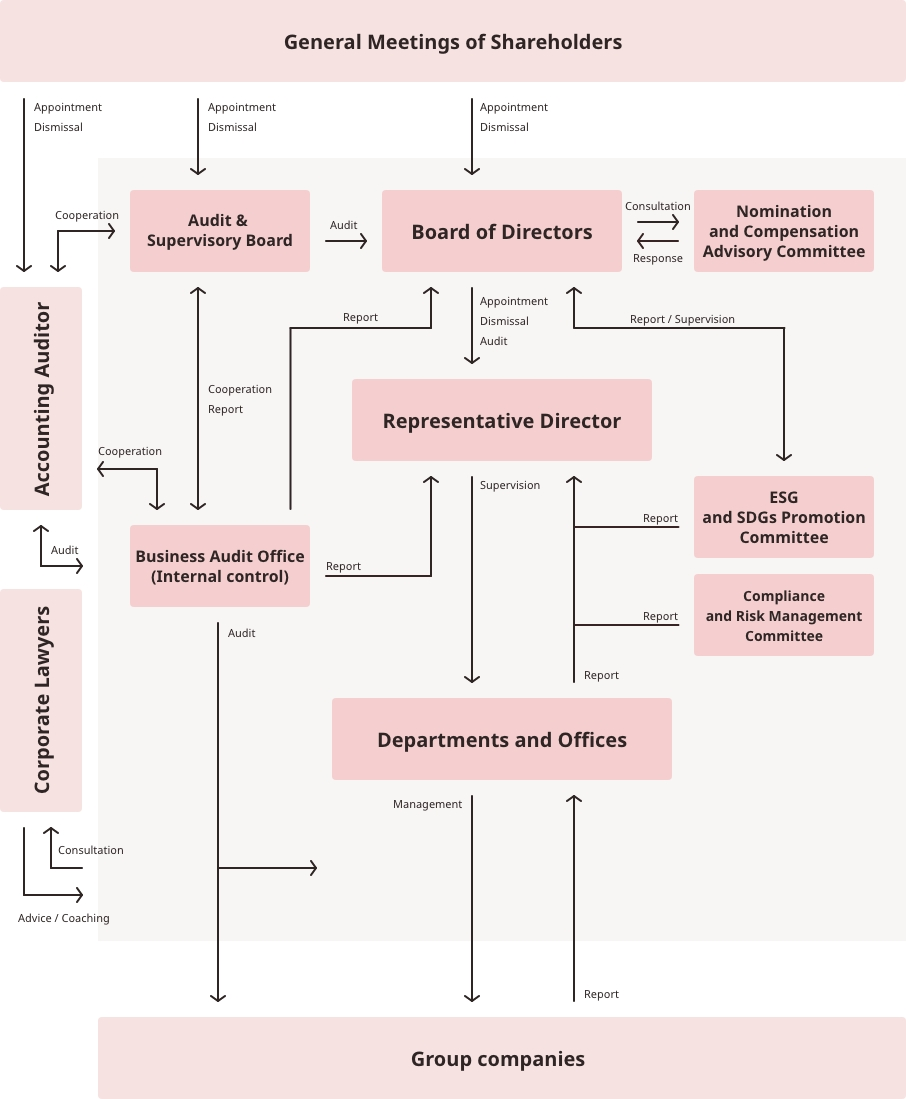

2. Corporate governance system (as of April 1, 2021)

3. Ensuring diversity of the Board of Directors

The Company has elected to be a company with an audit & supervisory board. The Board of Directors consists of six Directors, three of which are External Directors. In addition, one of the External Directors is a female. All three External Directors (and three External Corporate Auditors) have been designated as Independent Officers based on the provisions of the Tokyo Stock Exchange and registered as such with the Exchange. The Company has established a system to ensure diversity at the Board of Directors and reflect the opinions of stakeholders, including shareholders, in the Board of Directors in a multifaceted and appropriate manner.

4. Utilization of External Independent Directors

The Company uses knowledge and advice of External Directors to stimulate deliberations at the Board of Directors, which promotes sustainable growth of the Company and strives to enhance corporate value over the medium- to long-term. By improving the environment that supports activities of External Directors, the Company will work to further improve corporate governance that reflects perspectives of stakeholders and enhances objectivity and transparency of management. When appointing candidates for External Directors and External Corporate Auditors, the Company selects candidates that satisfy the Independence Criteria for External Officers, which have been established separately, have abundant corporate management or academic experience, or sophisticated professional knowledge and experience in legal affairs, finance, accounting, etc., are able to perform their duties on their own from a neutral and objective perspective, and are unlikely to have a conflict of interest with general shareholders.

7. General Meetings of Shareholders as opportunities for dialogue

The Company works to create an appropriate environment in which shareholders are able to exercise their rights. Traditionally, the Company has participated in the Electronic Voting Platform, which enables institutional investors to electronically exercise their voting rights at General Meetings of Shareholders. In addition, in order to utilize General Meetings of Shareholders as opportunities for dialogue with as many shareholders as possible, the Company sends out a notice, etc. of a General Meeting of Shareholders prior to the statutory deadline (approximately 19 days before the Meeting). The Company also holds a Meeting on a Saturday and avoids dates on which general meetings are concentrated so that it will be easier for our shareholders to attend the Meeting. After a General Meeting, the Company holds a business briefing session led by the Representative Director, and after explaining our business strategies using financial results briefing material, the Company responds to a number of questions from shareholders.